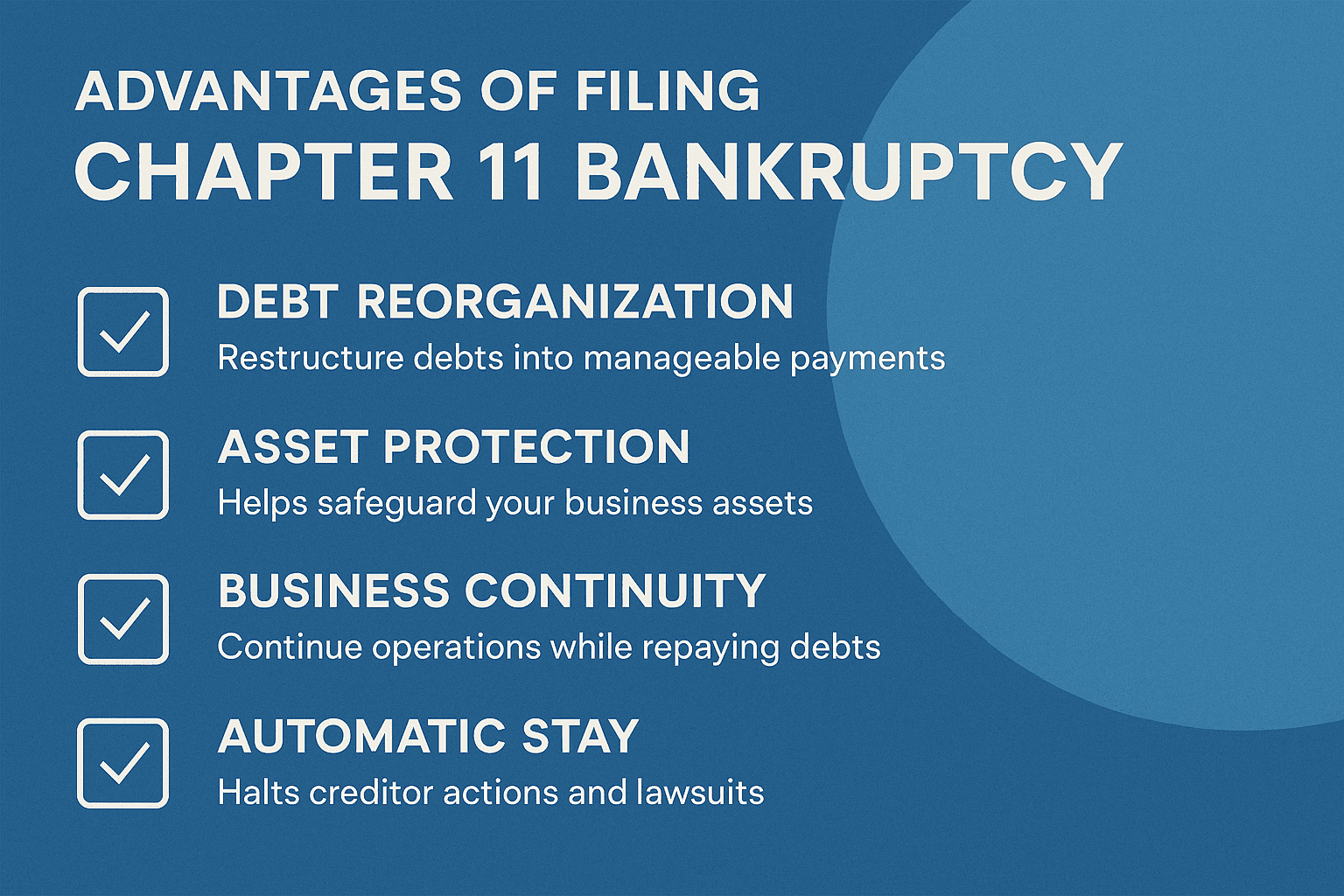

Chapter 11 bankruptcy is designed to help businesses and individuals facing overwhelming financial challenges reorganize their debts and regain stability while continuing operations. At The Law Office of Adam I. Skolnik, P.A. in Deerfield Beach, we guide clients through every step of the Chapter 11 process with experience, precision, and compassion.

This form of bankruptcy allows companies and high-debt individuals to restructure obligations under court supervision, creating a manageable repayment plan that satisfies creditors while preserving valuable assets. Attorney Adam I. Skolnik helps clients negotiate with lenders, manage cash flow, and implement practical plans that promote long-term recovery and renewed financial health.

Our firm has extensive experience representing both debtors and creditors in Chapter 11 proceedings, offering clear strategies to resolve complex legal and financial issues. We take the time to analyze each case, identifying opportunities to reduce liabilities, protect business interests, and restore profitability.

Whether you are a small business owner, corporate entity, or individual facing substantial debt, our goal is to help you reorganize efficiently and emerge stronger. Located in Deerfield Beach, The Law Office of Adam I. Skolnik, P.A. is dedicated to providing trusted, personalized legal counsel that safeguards your rights and secures your financial future.

Take control of your situation schedule a confidential consultation today to discuss how Chapter 11 can help you achieve lasting debt relief and business stability.